How Budgetocity and Income-Based Budgeting Can Save Your Financial Life

How Budgetocity and Income-Based Budgeting Can Save Your Financial Life

When it comes to managing your money, most budgeting tools focus on where your cash goes — tracking expenses, categorizing purchases, and reminding you that, yes, you spent $150 on takeout last month. But what if the smarter move is to focus not on your spending habits, but on your earning habits?

That's where Budgetocity comes in.

What Makes Budgetocity Different?

Budgetocity flips traditional budgeting on its head by putting your income at the center of your financial plan. Instead of forcing you to track every coffee and subscription, Budgetocity helps you plan where your money will go the moment it hits your bank account. It's not about shaming your past; it's about directing your future.

The Problem with Expense-Based Budgeting

Typical budgeting methods make you feel like you're constantly behind. You're reactive instead of proactive. You look at what you spent after you spent it, then try to fix things retroactively.

The result? Stress. Guilt. And often, abandonment of the budgeting system altogether.

The Power of Income-Based Budgeting

With income-based budgeting, you build a plan before the money comes in. Every dollar you earn already has a job to do. It might go toward:

- Monthly bills

- Debt payoff

- Savings goals

- Fun money (yes, that's important too!)

This method ensures you're living within your means instead of constantly playing catch-up.

Why Budgetocity is the Ultimate Tool for This Approach

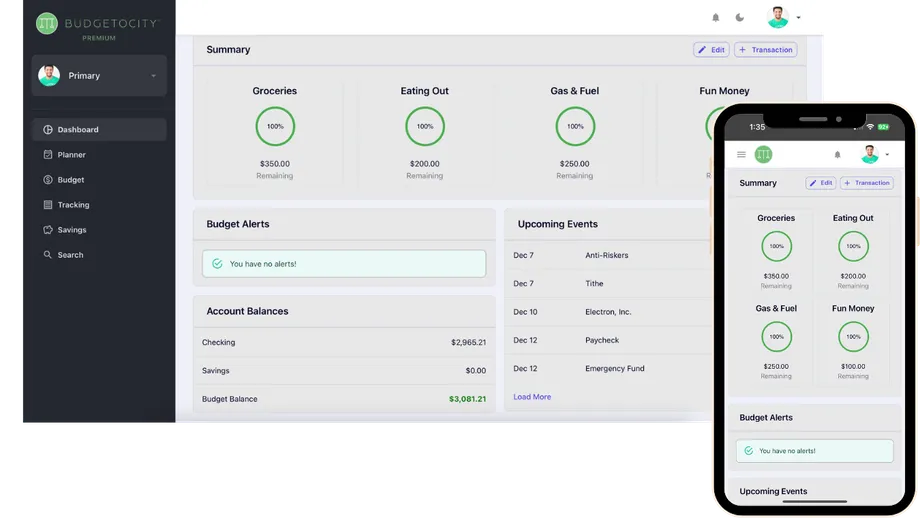

Budgetocity was designed from the ground up to help you budget based on your income. Here's what sets it apart:

- Smart Allocation Tools: Automatically assign portions of your paycheck to bills, goals, and spending categories.

- Debt Management Features: Use snowball or avalanche methods to crush debt with purpose.

- Goal-Driven Interface: Saving for a house, emergency fund, or vacation? Budgetocity keeps those goals front and center.

- No Judgment, Just Progress: Budgetocity doesn’t scold you for the past. It helps you win in the future.

Real People, Real Results

Thousands of users have already transformed their finances with Budgetocity. They’ve paid off credit cards, saved their first $1,000, and finally feel in control of their money.

Take Control Today

Budgeting doesn’t have to be painful. With Budgetocity and an income-first mindset, you can take control of your finances, reduce stress, and actually enjoy managing your money.

Your income is your greatest wealth-building tool. Let Budgetocity help you use it wisely.

Start budgeting with intention. Start with Budgetocity.