Budgeting With a Twist™

We've all been there. It's the beginning or end of the month, and we have no idea where our money went. But it doesn't have to be that way. We've made it our mission to help you take control of your spending.

Create a Plan

Build a budget plan that works around your income schedule. Whether it's monthly, yearly, or irregular bills, planning your expenses based on when you get paid ensures you're always prepared.

Learn moreBuild a Zero-Based Budget

Make every dollar count with a traditional "zero-based budget". Here's the twist - our Planner helps drive your budget. You will know when you need to budget for something, and when you don't, automatically!

Learn moreTrack Your Spending

Easily track your spending to stay within your budget limits. With our premium features, you can sync directly with your bank accounts, ensuring real-time updates and eliminating the hassle of manual tracking.

Learn moreCustomize Your Budget Categories

Don't let other budgeting apps box you in with generic categories. Tailor your budget categories to fit your unique lifestyle and financial goals.

Learn moreNo credit card required. Free forever.

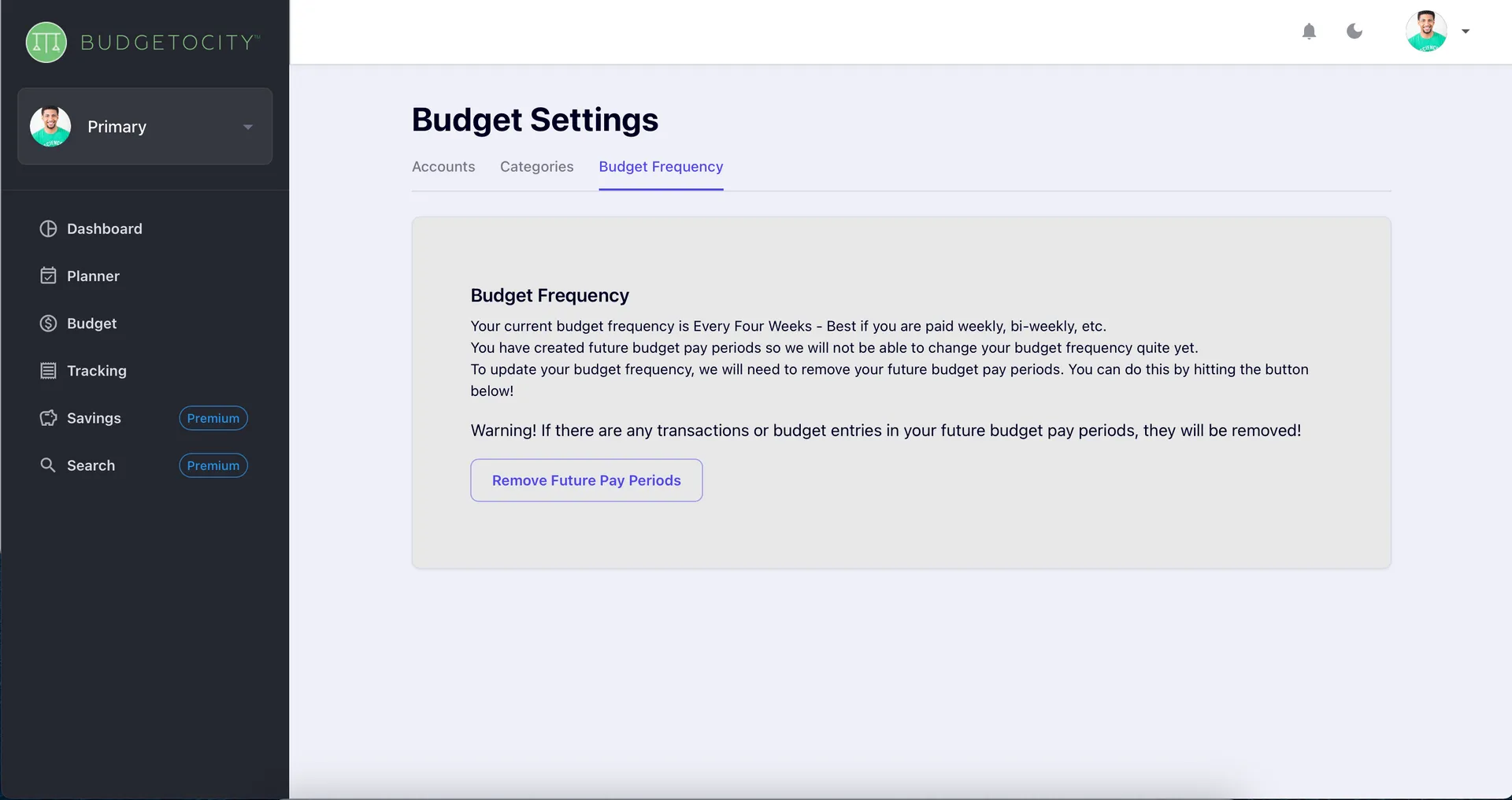

Income-First Planning

Build budgets around your paycheck schedule

Traditional budgeting apps force you to think in calendar months, but your bills don't always align with the first of the month.

Create budget plans that sync with your actual income schedule - whether you're paid weekly, bi-weekly, monthly, or have irregular income.

Set up automatic planning cycles that match when you receive money, making it easier to allocate funds before they're spent.

Plan for both recurring and one-time expenses with intelligent scheduling that shows you exactly when you need money for what.

Key Benefits:

- Eliminates the stress of mid-month money shortages

- Aligns your budget with your actual income timing

- Provides clear visibility into future financial needs

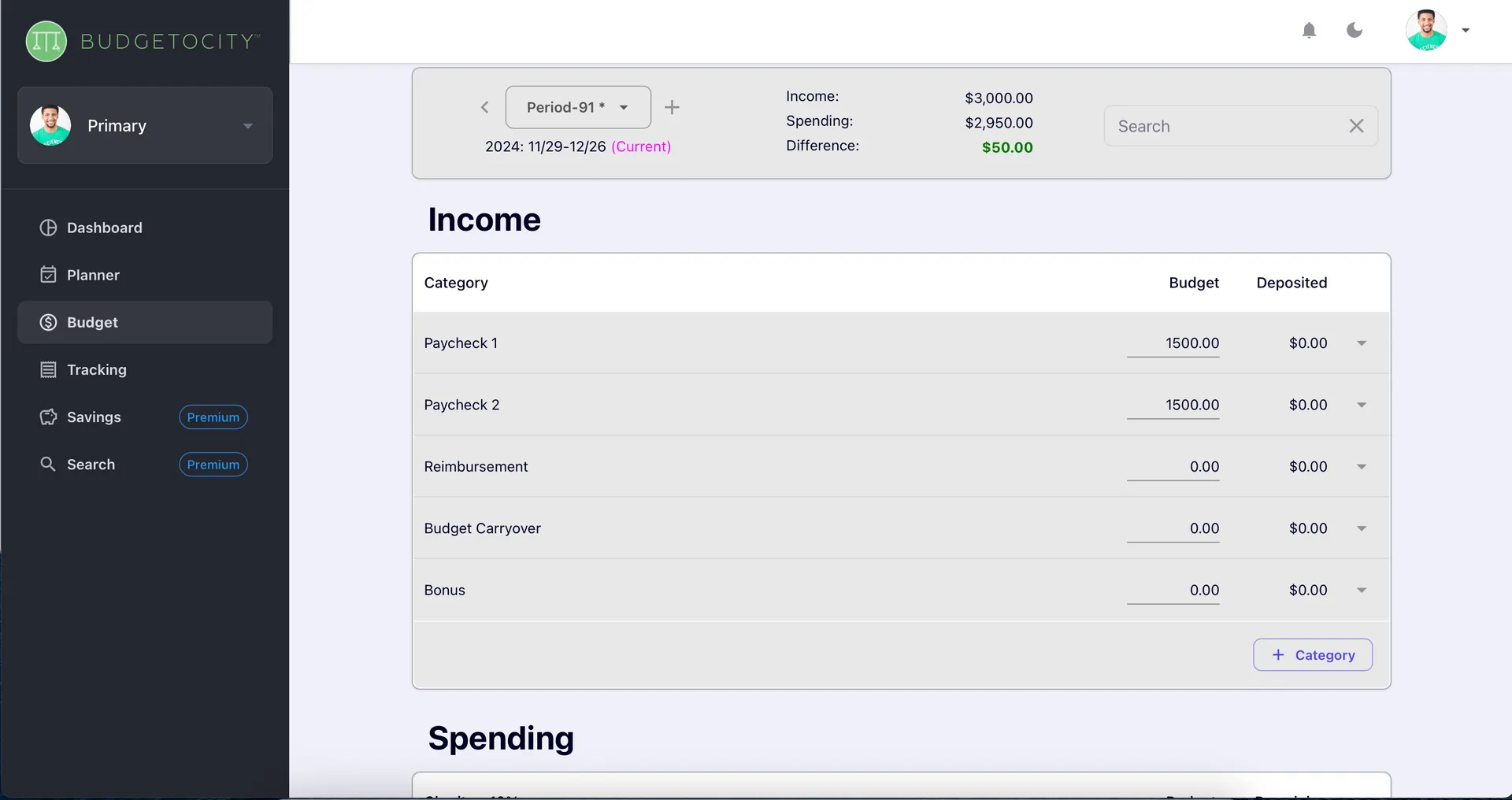

Zero-Based Budgeting Made Smart

Every dollar has a purpose, automatically

Zero-based budgeting ensures every dollar you earn has a specific job, but traditional methods require constant manual updates.

Our intelligent system automatically suggests budget allocations based on your planning schedule and spending history.

Quickly assign every dollar to specific categories like savings, bills, and discretionary spending with guided recommendations.

Get real-time alerts when your budget allocations don't add up to your available income.

Key Benefits:

- Ensures every dollar is purposefully allocated

- Prevents overspending through proactive planning

- Builds strong financial discipline naturally

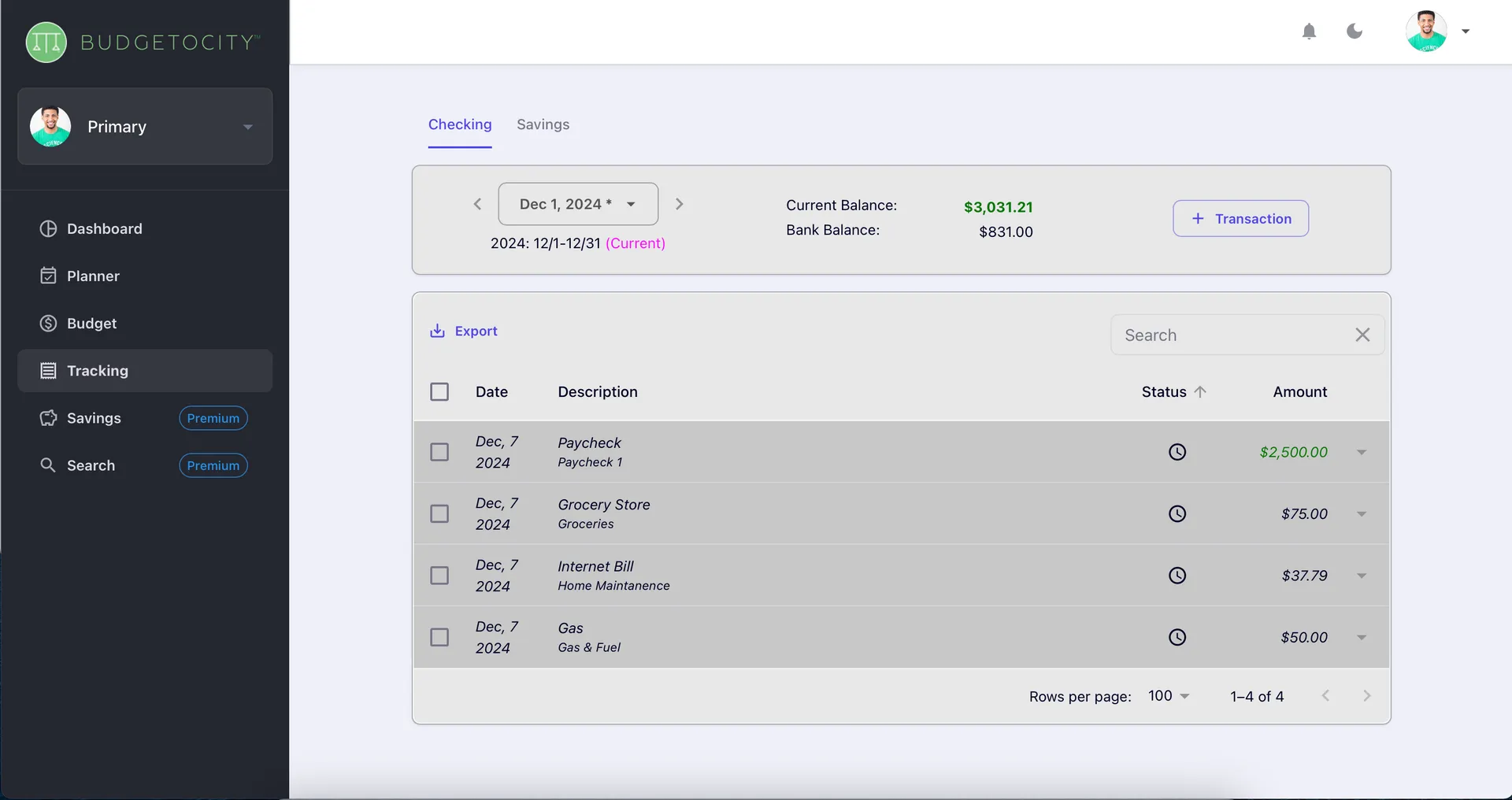

Effortless Expense Tracking

Real-time spending insights without the manual work

Tracking expenses shouldn't be a daily chore. Our smart tracking system keeps you informed without overwhelming you with data entry.

Connect your bank accounts for automatic transaction import and categorization.

Use our mobile app to quickly capture cash purchases and receipts with smart photo recognition.

Get instant notifications when you're approaching budget limits in any category.

Key Benefits:

- Saves hours of manual expense entry each month

- Provides real-time spending awareness

- Helps identify spending patterns and leaks

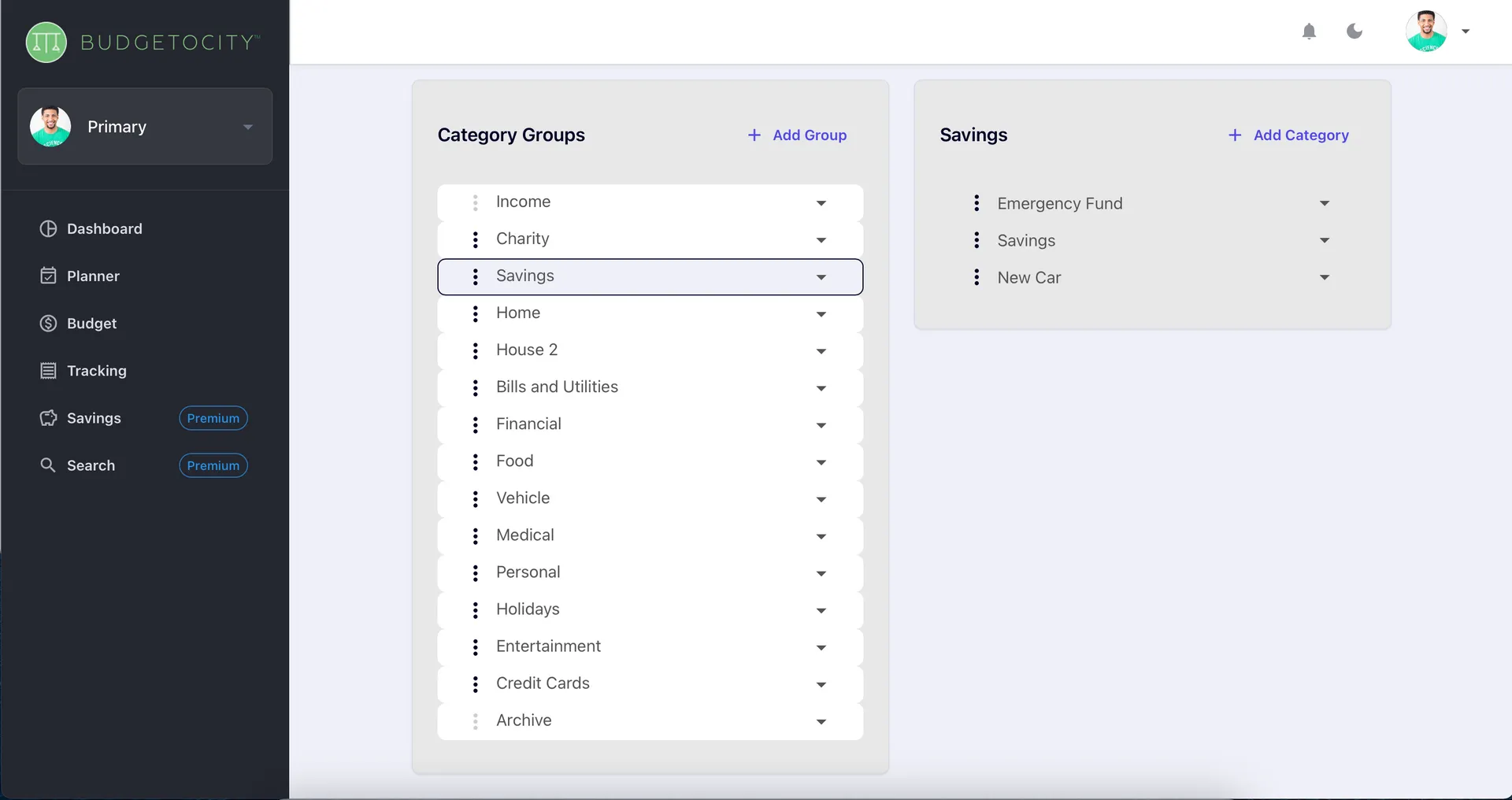

Truly Customizable Categories

Budget categories that fit your actual life

Generic budget categories like 'Miscellaneous' don't help you understand your spending. Create categories that reflect your real priorities and lifestyle.

Create unlimited custom categories that match your specific spending patterns.

Organize categories into groups that make sense for your financial goals.

Set different budget rules for different categories - some can roll over, others reset each period.

Key Benefits:

- Creates meaningful spending insights

- Eliminates confusing miscellaneous categories

- Makes budgeting feel personal and relevant